Tenant Screening

Tenant screening designed for landlords

Quickly find trustworthy renters with TenantCloud’s 99.9% accurate background and credit checks.

99.9% background check accuracy

Save more with flexible bundles and add-ons

ResidentScore® offers 15% better eviction risk predictor

Fast and easy—run background checks right from an application

- Online Rent Payments

- Maintenance Management

- Listings and Applications

- Enhanced Reporting

- Move In/Out Inspections

- Property Message Board

- Team Management & Tools

- Task Management

- User-Interface Customization

Prices exclude any applicable taxes.

FAQs

What is the purpose of a tenant screening process?

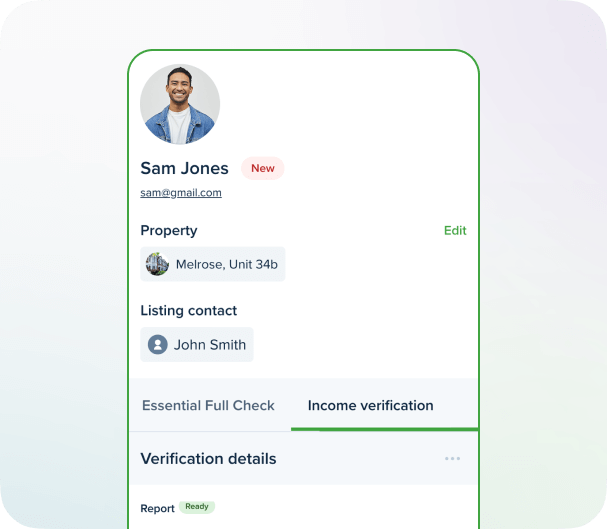

As a property manager or landlord, you’re always looking for ways to improve business, which is why you should consider tenant screening. Our property management software provides a comprehensive range of services, including tenant screening.

A tenant screening report helps landlords choose the best applicant for a vacant rental unit. Reviewing a tenant's rental history and asking a few questions is not enough to make a well-informed decision. Therefore, tenant screening is the most effective way to identify desirable tenants from undesirable ones.

TenantCloud's tenant screening services offer the following benefits for property owners:

- Lower risk of liability

- Less crime and vandalism

- Fewer vacancies and lost income

- Improved tenant screening services

Tenant screening interviews are a great way to learn more about the people you're thinking of renting to and ensure that your property is in good hands. It is often recommended as a part of the rental application process.

Pre-screening questions allow landlords to eliminate prospective renters who don't meet their criteria. In addition to finding more reliable tenants, pre-screening gives you the chance to establish expectations for the rental process from the start.

We highly recommend running a full background check with pre-screening questions to strengthen decision-making. Candidates may intentionally give confusing answers, have a selective memory, or pull responses out of thin air if they aren't sure. Pre-screening questions are a simple approach to attracting responsible tenants and saving time and money in the long run.

What is a tenant screening report?

A tenant screening report is a document that shows an applicant's financial and rental history. It details a person's payment history, eviction history, criminal history, and any red flags before a tenant moves into your rental. Manual tenant screening can be time-consuming and often does not include the whole picture; using property management software is an efficient and reliable way to ensure you’re doing your due diligence.

Tenant screening should always include:

- Credit reports: including how much debt they have and whether they pay their bills on time to ensure they don't have a habit of falling behind.

- Criminal records: including whether they have been convicted of any crimes, so you can make sure your properties are in good hands.

- Employment records: including whether they have been fired from any jobs, and meet income requirements.

- Rental history: including whether they have ever been evicted from a property.

TenantCloud makes it easy to run a tenant background check, including criminal records, work history, past evictions, and more, thanks to tenant screening services provided by credit bureaus. A background and credit check and a search of national eviction records are all part of a full tenant screening report.

You can feel secure in the tenants you accept into your rental property with the help of TenantCloud's background and credit checks. After you've made sure your rental property is in good hands, you can move on to other matters.

How can landlords assess the accuracy and reliability of tenant screening providers before making a decision?

- To evaluate accuracy and reliability, landlords should look at data sources, legal compliance, report transparency, and update frequency. Reputable screening services clearly explain the origin of their data, how frequently it's updated, and how reports comply with the Fair Credit Reporting Act (FCRA) and relevant state laws. TenantCloud partners with established, FCRA-compliant screening providers and clearly outlines what each report includes.

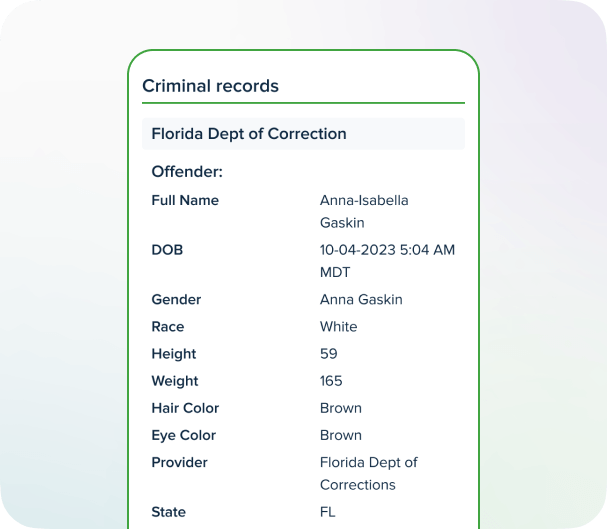

What does a tenant background check show?

By searching national criminal records, state data, the national sex offender registry, and OFAC/most wanted lists, landlords can learn a lot about a prospective tenant's background. This will allow you to verify the individual's identity by looking into their past and verifying the information they provided about their criminal record, education, employment, and other personal details.

- Criminal background check - when reviewing an applicant's criminal history, it's common to evaluate the kind of offense, the severity, and the length of time since the crime was committed.

- Sex offender registry check - this registry is a list of all sex offenders who have been convicted in a certain state. The address, physical appearance, and criminal history of a sex offender are often included in registers.

- Reference from a previous landlord – this is not necessary but always welcomed.

- Eviction history - do not forget to verify that your potential tenant has a clear eviction history.

- Instant State Data

- OFAC/Most Wanted Searches

Performing background checks can help you select the right tenants who can pay their rent on time, as well as protect your property and follow lease terms during their tenancy.

Effective tenant screening increases tenant retention in a variety of ways; for example, tenants who rent a property for a longer period of time are more reliable. For both parties, a polite tenant-landlord relationship makes life easier.

We highly recommend performing a criminal background check for all potential tenants without exception. Background checks are necessary to avoid eviction. Not only are evictions upsetting, but they may be expensive and protracted, especially if the tenant contests them.

Why is a tenant credit check important?

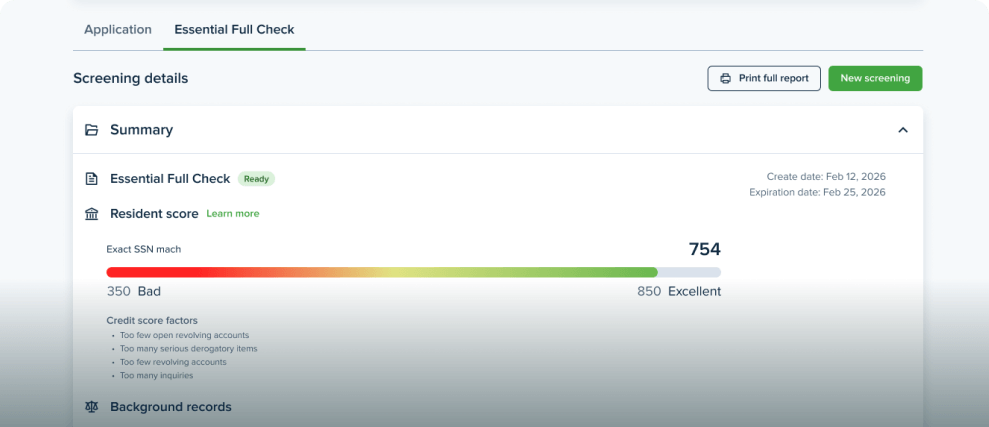

A credit check and report will summarize an applicant’s credit history, which helps ensure a tenant is trustworthy. This report includes SSN verification, address history, bankruptcy searches, and a full credit report with a resident score.

A credit report gives a complete understanding of their financial situation and responsibility based on their credit score.

After a credit check, you should know:

- If the tenant has a history of late payments at other properties.

- If the tenant has any frozen accounts.

- If the tenant has a history of dishonest check-writing, bankruptcy, or other unfavorable financial practices.

Many applicants won't provide this information voluntarily, but knowing potential tenants’ financial situation beforehand will help to anticipate how they'll handle paying monthly bills. For instance, if an applicant has a history of credit card debt, this may indicate that they have trouble making payments on time, which is a big issue when rent is due each month. On the other hand, if someone has consistently made timely payments on their debts and expenses, you can generally rely on them to make their rent payments as well.

How can tenants build their credit history with TenantCloud?

A good credit score means that a tenant will be capable of paying rent. With the help of credit bureaus, landlords can understand how a potential tenant has handled payments in the past on loans, credit cards, and other items by looking at their credit records.

TenantCloud offers the Rent Reporting option that reports tenants’ rent payments to credit bureaus to help build a credit history and credit score. When a tenant pays rent through the system, payments are reported to the following credit reporting bureaus in the US:

- TransUnion

- Equifax

Ongoing reporting of your on-time payments helps to establish a good record. This is an excellent way to build credit scores, which will mean more access to better properties.

Future renters can benefit from rent data reporting. Landlords want to know that they can trust their tenants, and having a payment history on your credit report sends that message.

How does rent reporting work?

Both positive (paid) and negative (unpaid) rental payments are reported to Credit Bureaus by our property management software. TenantCloud counts as a successful rent payment whenever a landlord marks an invoice as "paid" in full.

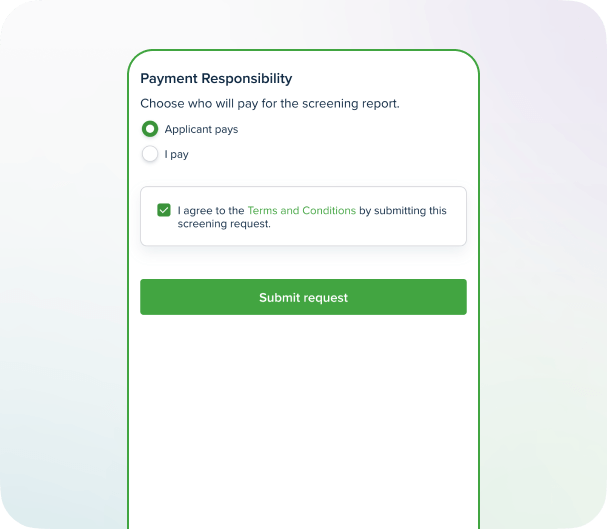

What's the most affordable tenant screening option that still helps identify high-risk applicants?

The most affordable option is one that includes credit, criminal, and eviction checks in a single screening report, without forcing you to pay extra for core reports. TenantCloud keeps tenant screening simple by bundling essential data into a single report, helping you quickly spot potential risks while keeping screening costs under control.

- Which tenant screening services provide the most comprehensive reports for identifying high-risk tenants?

The most comprehensive tenant screening services combine credit history, nationwide criminal records, eviction data, and income and employment verification into a single, easy-to-read report. The key isn't having more data, but having it organized clearly so potential risks stand out quickly. TenantCloud's tenant screening reports help you find red flags and avoid fraudulent documents. Instead of juggling multiple reports or third-party tools, you get a consolidated view of an applicant's rental risk directly inside your property management workflow—helping you make informed decisions faster and with more confidence. - Which tenant screening tools provide the best balance between report quality and cost?

Tenant screening tools offer the best value when they focus on usable insights, not just raw data. TenantCloud reports are designed to be organized, easy to read, and immediately actionable — helping you make confident decisions without paying extra for unnecessary add-ons or complex analytics you won't use. - How do cheaper tenant screening reports compare to higher-priced options?

Lower cost reports often cover the basics, but the real difference comes down to clarity, reliability, and workflow integration. With TenantCloud, tenant screening flows with your rental process, delivering reliable data at affordable packages. This means fewer delays, less guesswork, and no need to jump between multiple platforms—best bang for your buck. - Which tenant screening platform offers the fastest screening results for landlords?

Fast screening platforms rely on automated identity verification, digital applications, and direct integrations with reporting agencies to minimize delays. In most cases, credit and identity reports are available almost instantly, while criminal and eviction checks may take longer depending on court record availability. TenantCloud is designed to streamline the screening process by allowing applicants to submit information online and complete screenings digitally, right through the dashboard.