Property Management Software

Get fast and easy financing to help you scale your rental portfolio with Stripe Capital.

Get started

Quick and simple

Flexible repayments

No impact on credit score

Apply in minutes

Effortless Funding Tailored to Your Needs

Receive the financing you need for your rentals without the common barriers, thanks to Stripe Capital’s quick and hassle-free application process.

Why financing can help your business

Why choose Stripe Capital? As a landlord or property manager, you deserve straightforward access to funds without all the hassle. Our streamlined process ensures you receive your funds fast, so you can keep your rental business running smoothly.

No Personal Credit Checks

Simple Repayment Structure

Fast Access to Funds

Use It for Any Rental Business Need

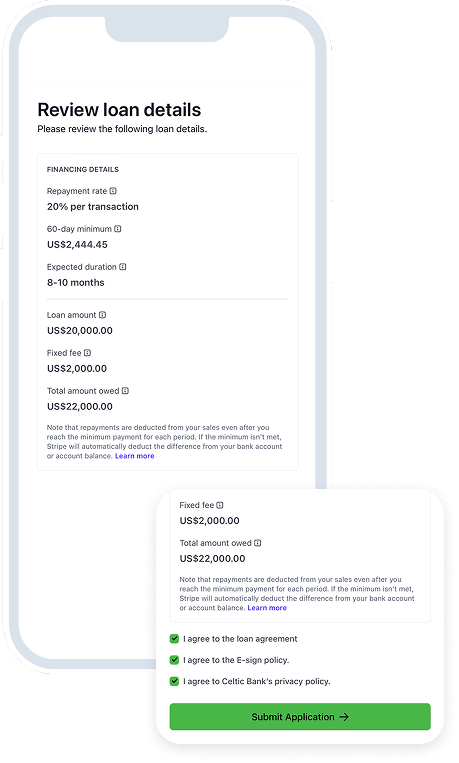

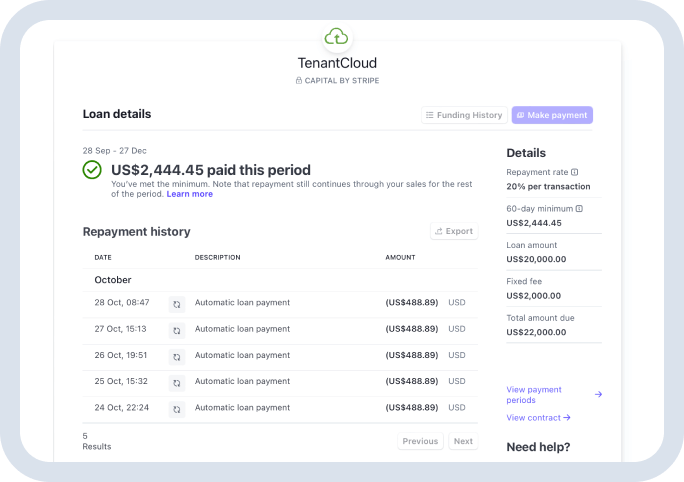

*You’ll have a minimum amount due each repayment period, and if the total amount that you repay through sales doesn’t meet the minimum, your bank account or account balance will be automatically debited the remaining amount at the end of the period.

How it works

- Apply in Minutes:

- Grow Your Business:

Log in to your TenantCloud account and check if you’re eligible for funding. If eligible, you can complete a quick and simple application.

If approved, you can then use the funds to invest in your rental properties and maximize profits.

Please note: This product is available only to eligible users. Loans subject to approval.

Learn More About Your Eligibility

If you’re a TenantCloud user, here are the eligibility requirements you need to know:

- Eligibility is determined based on factors related to your rental business performance, including rental income and account tenure with TenantCloud.

- TenantCloud users are automatically reviewed for eligibility on a regular basis.

- Funding offers are available for up to 30 days, after which they will expire, and you’ll be reevaluated for eligibility.

Loans are Issued by Celtic Bank and powered by Stripe. All loans are subject to credit approval.

Pricing & Plans

- Enhanced Reporting

- Move In/Out Inspections

- Property Message Board

- Team Management & Tools

- Task Management

- User-Interface Customization

How do you determine who qualifies for an offer?

Eligibility is determined based on a combination of factors, including overall sales volume and history with TenantCloud. Eligible US businesses will receive an email and Dashboard notification if they have an offer available.

Do I have to pay interest?

No, you’ll pay one flat fee that does not change. You won’t pay any interest on top of this fee.

Will applying for an offer affect my personal credit rating?

No, there is no personal credit check. All offers are based on your history with TenantCloud.

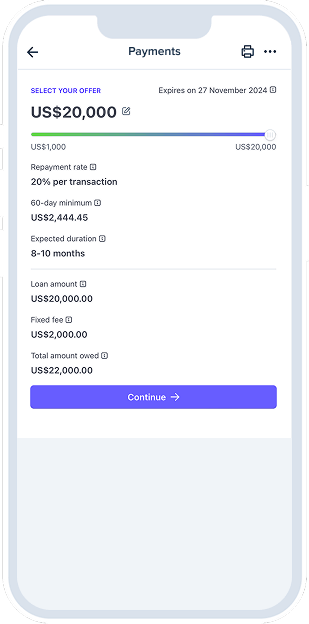

Can I request a different offer amount?

When you log into your TenantCloud Dashboard, you can use a slider to choose a custom amount (up to the maximum offer amount). The loan fee and repayment rate adjust based on the amount you choose.

When do I need to pay the flat fee?

You’ll automatically pay the flat fee through a percentage of your sales until the total amount owed is repaid. The fee isn’t charged up-front.

After I accept an offer, how quickly will I get my funds?

If your application is approved, you’ll see the funds in your bank account typically in as soon as 2 business days. To make sure that funds are disbursed successfully, you must set a valid bank account as your primary payout method.

Can I have my Capital funds paid out to a card?

We currently don’t support disbursal of funds to a card. To make sure that funds are disbursed successfully, you must set a valid bank account as your primary payout method.

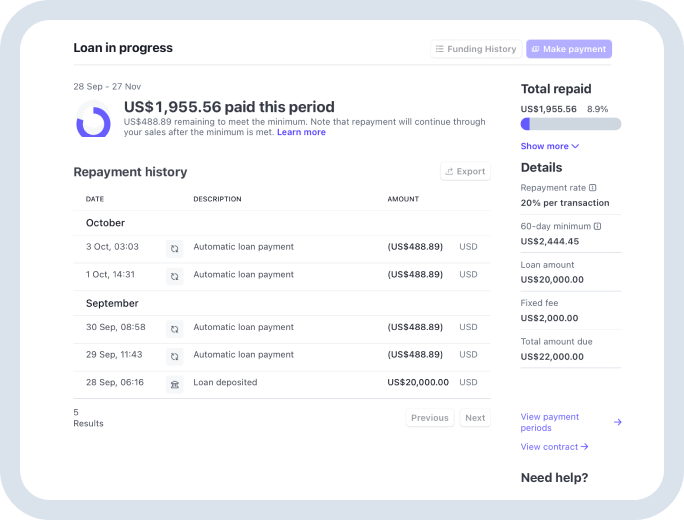

Can I repay my loan early?

Yes, you can make additional payments or pay the total amount owed in full at any point by clicking the ‘Make Payment’ button in your Dashboard. There are no additional fees for early repayment.

How should I report these funds on my taxes?

Tax reporting is often dependent on your specific situation, so we encourage you to talk with a tax advisor to ensure appropriate accounting. In general, Stripe Capital funds would not be considered taxable income at the time of receipt, and the amounts withheld to satisfy your obligations are not tax deductible.

Who can I contact to learn more about the Stripe Capital programme?

If you have additional questions about how our financing programme through Stripe Capital works, you can contact our partners at capital+support@stripe.com.